Listen up, degenerates. It’s Dave Crypto, and today, we’re diving headfirst into the blood-soaked pit of financial warfare: stocks versus crypto. The age-old battle between Wall Street suits and blockchain rebels rages on, but which side of the battlefield is more profitable? More dangerous? More unhinged?

We’re about to find out.

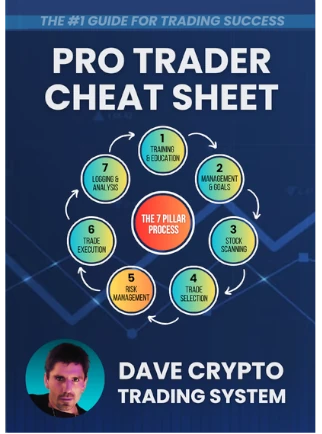

I am Dave Crypto, if you don’t know who I am read the About Dave Crypto page here, or check out my author profile.

The One-Year Crypto Vs. Stocks Performance Cage Fight

Let’s cut through the noise and get to the numbers. Here’s a one-year return chart featuring the S&P 500 (the grey-haired granddaddy of markets) versus the heavyweights of crypto: Bitcoin, Ethereum, and Solana.

- S&P 500: +32.43% YTD. Not bad. Solid. Like a trusty old sedan that won’t leave you stranded in a bear market.

- Bitcoin: +127.65% YTD. Now we’re talking. This isn’t a sedan—it’s a nitro-boosted, moon-bound rocket.

- Solana: +114% YTD. Pure volatility. If Bitcoin is the moon mission, Solana is the drunk pilot in control.

Show me a mutual fund, a real estate play, or a treasury bond that gives you these kinds of returns. You can’t. And that’s why crypto is the wildest game in town.

But before you go full degen and sell your grandma’s retirement fund for PepeCoin, let’s break it down properly.

Pros of Trading Stocks: The Boring but Stable Bet

Regulation and Stability

The stock market is a highly regulated playground. Public companies answer to the SEC, boards of directors, and shareholders. You won’t wake up to find Apple rugged its investors overnight.

Established History

Stocks have decades, even centuries of historical data. Companies have financial statements, book values, and real-world assets. You can actually do due diligence without consulting a Twitter thread from some anonymous frog avatar.

Liquidity

The big leagues—think Apple, Tesla, Microsoft—see billions in daily trading volume. Unlike some altcoins, where your buy order might be the only action in an hour, you can get in and out of major stocks without much slippage.

Dividends: Free Money?

Some stocks literally pay you just for holding them. Try finding a meme coin that deposits money into your account instead of evaporating overnight.

Lower Volatility

Compared to crypto, stocks are the stable, responsible older brother. They don’t randomly drop 40% because some billionaire tweeted a poop emoji.

If you don’t have a brokerage account yet. I recommend Interactive Brokers for the best prices.

Get IB Now

Cons of Trading Stocks: The Chains of Wall Street

Limited Trading Hours

Stock markets close at 4:00 PM EST like some old man who needs his beauty sleep. Meanwhile, crypto is awake, hopped up on energy drinks, trading 24/7 like a lunatic.

Slower Gains

Sure, you won’t see a 1000x overnight in the S&P 500, but you also won’t experience the sheer terror of watching your investment evaporate in five minutes.

Higher Entry Barriers

PDT rules, KYC requirements, minimum account balances—stocks have some red tape that crypto doesn’t.

External Influences

Earnings reports, politics, interest rate hikes from Jerome Powell—all of these factors influence stock prices. In crypto, none of that matters. A Shiba Inu meme can send a coin to the moon.

Pros of Trading Crypto: The High-Risk, High-Reward Circus

24/7 Trading

Crypto doesn’t sleep. No market hours, no weekends off. If you want to trade at 3 AM in your underwear, go for it.

Absurdly High Potential Returns

Thousand X plays happen. Not often, but enough to keep every degenerate trader hooked. Meme coins can 10x overnight. If you time it right, you can go from ramen noodles to filet mignon in a week.

Decentralization

No middlemen. No banks. Just you, your wallet, and the chaotic magic of the blockchain.

Low Entry Barriers

No need for a brokerage account or government permission. Just download a wallet, buy some coins, and dive in.

Innovation Playground

Crypto isn’t just about trading—it’s a tech revolution. DeFi, NFTs, smart contracts, Web3… traditional finance moves at a snail’s pace compared to the mad scientist lab that is crypto.

Cons of Trading Crypto: The Financial Wild West

Extreme Volatility

If you can’t handle seeing your portfolio swing 30% in an hour, crypto will break you. This is not a market for the weak.

Regulatory Uncertainty

Governments still don’t fully know what to do with crypto. Today it’s legal, tomorrow they ban your favorite exchange.

Security Risks

Hacks, scams, rug pulls—crypto is riddled with landmines. If you lose your private key, say goodbye to your funds. No customer support hotline will save you.

Limited Historical Data

Bitcoin started in 2009. The stock market has been around since the 1700s. If you’re looking for long-term trends, there’s just less data to work with in crypto.

Liquidity Issues

Bitcoin is liquid. Ethereum is liquid. But your favorite small-cap altcoin? Probably not. Market manipulation, thin order books, and pump-and-dump schemes run rampant.

Stocks Vs. Crypto: The Ultimate Cock Fight

If you want stability, trade stocks. If you want chaos and massive potential gains, trade crypto.

Or be a true degen and trade both—just don’t forget to hedge your bets and strap in for the ride.

At the end of the day, it’s all about timing, strategy, and how much insanity you can stomach.

Drop your thoughts below. Are you team stocks, team crypto, or team ‘send it and pray’?

Like, share, and subscribe, degenerates. We’re just getting started.